New Generation

Customer Satisfaction

SATISFACTION THAT SATISFIES. FINALLY. (A 2 minute video.)

(Be sure to run the video in fullscreen by clicking on the icon below.)

SATISFACTION THAT SATISFIES. IT'S TIME. (VIDEO)

THE LIMITATIONS OF CONVENTIONAL APPROACHES

CUSTOMER SAT. USING DECISION SUPPORT ENABLEMENT (DSE)

THE PHASES and STEPS

OF A DSE CUSTOMER SAT. ENGAGEMENT

KEY BENEFITS

EXAMPLE CLIENTS

CONTACT / QUESTIONS

VIDEO

CENTER

CONSULTING

PLATFORMS

SOFTWARE

SOLUTIONS BY INDUSTRY

THE LIMITATIONS OF CONVENTIONAL CUSTOMER SATISFACTION APPROACHES

Why Do Conventional Customer Satisfaction Engagements So Often Fail?

-

The CSM landscape is littered with the carcasses of failed approaches and costly measurement systems that do

not

link to behavior:

- Both academics and practitioners have demonstrated that standard CS measurement (CSM) links to only one thing consistently....likelihood to recommend.

- Even worse yet, Improving CSM dramatically barely moves the needle on retention...and on virtually nothing else.

- Worst of all, over 95% of CSM recommendations cost more money than they produce.

-

The

data

collected is incomplete or inadequate. The measurement system:

- Misses important drivers of satisfaction.

- Does not determine new customer capture thresholds - how much improvement or differentiation is needed to get a prospect "off the dime."

- Doesn't recognize that the average customer has only 3-4 key drivers and that across needs segments most markets have only 25 key drivers - not hundreds of drivers.

-

The

decision support

system: the tool that "sees and mines" the capture data:

- Doesn't allow "what-iffing" because it hasn't created a true E-customer - an electronic copy of the each representative consumer in the market place.

- Doesn't automatically test hundreds of millions of change strategies (that's how many combinations exist in products with four operational levels for each of 25 key drivers.

- Doesn't place the needs of new customers and the current product offerings on the same competitive space - so strategists will not know how much share will come from cannibalization.

- Doesn't hone in on those strategies that maximize the things we really care about, retention of high profitability customers, increased sales, and increased margin.

REINVENTING CUSTOMER SATISFACTION USING DECISION SUPPORT ENABLEMENT (DSE)

What if a Far More Powerful Customer Satisfaction Protocol Existed? One that:

-

Linked to real world outcomes like:

- Purchase, Sales/Revenue

- Retention

- Profit/Marginal Benefit

-

Retained all the truly useful capabilities of customer satisfaction such as:

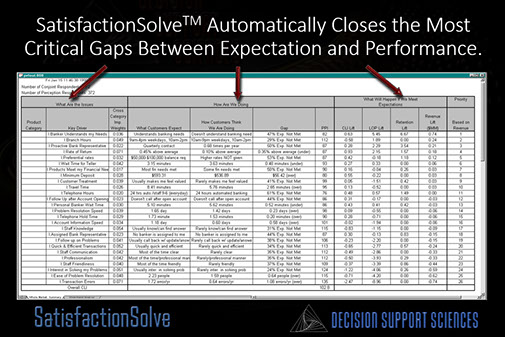

- Full key driver metrics (importance, performance, expectation)

- Likelihood to recommend

- Gap analysis (importance vs. performance)

- Tested millions of strategies to close the gap between importance and performance at the lowest cost to implement AND maintain.

Moreover, What If It Had the Ability to:

- Present any product -- in any configuration -- to your E-customers? And identify the optimal product configurations that:

-

- Maximized preference (Preference modeling)

- Caused the maximal number of non-customers to switch to you (Switching modeling)

- Maximized retention (Retention Modeling)

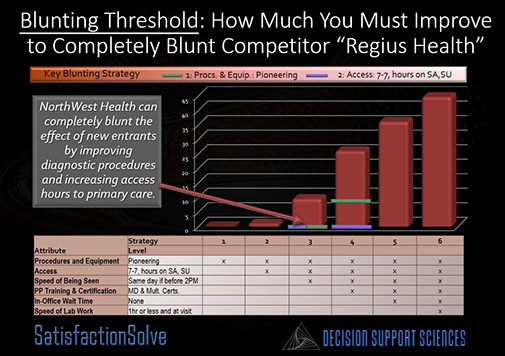

- Best protected you against competitive attacks (Blunting modeling)

- Maximized market share at the least cost (Price Partial modeling)

- Automatically build and test millions of potential product configurations

- Be so turn-key that it could be run by non-experts in-house?

Decision Support-Enabled (DSE) Customer Satisfaction achieves all these outcomes and more. Higher accuracy CS strategies at a far lower cost. Delivered you way. That's enablement.

PHASES AND STEPS OF A DSE CUSTOMER SATISFACTION ENGAGEMENT

(Click on the first icon below to start the slide show.)

KEY BENEFITS (Place your pointer over the benefits to see the short description.)

There is no pretty way to say it. Customer Satisfaction Measurement (CSM) has utterly failed. It's legacy? CSM deeply measured metrics that did not link to the promised real-world outcomes. We discovered this in 1994...even before Fred Reicheld published his landmark insight that CSM linked reliably to only one thing: the likelihood to recommend. This also led us to survey actual practitioners...to see how deep the CSM rabbit hole really went. See their quotes above! Their insights coupled with other data led us to re-engineer CSM into producing value for both the organization and the customer -- a business line we call Customer Value Maximization (CVM).

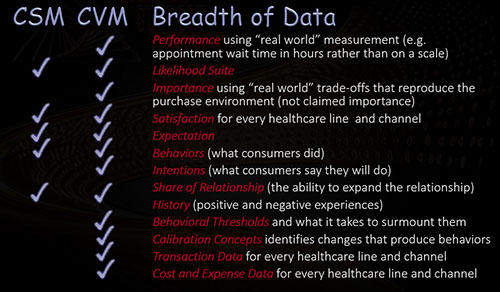

CVM (Customer Value Maximization) uses the broadest measurement model in the industry. These measures have two primary advantages over CSM's measures. First, by using a far broader set of measures (not just attitudinal, but behavioral, historical, threshold, cost, calibration etc.) we characterize the customer far more deeply. Second, we use psychometrically informed approaches to collect the data. These approaches recognize that certain attitudes are typically overstated or understated by consumers. (See the explanation of Real World Expectation below as an example.) These two advantages allow SatisfactionSolve™'s deep insight discovery tools to develop more risk-mitigated strategies than ever before.

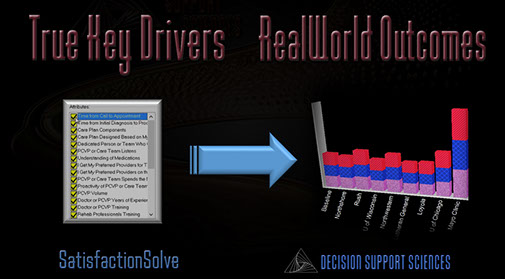

Traditional CSM only links to one thing reliably; likelihood to recommend. This finding was initially confusing for many researchers. After, all it seemed reasonable that if overall satisfaction improves that Real World Outcomes (RWO's) such as sales and revenue -- should naturally follow! The problem? Customer Satisfaction is only a general attitude. Structural Equation Modeling, in contrast, demonstrates that both attitudes AND prior behaviors are needed to change the latent factors that REALLY do link to RWO's. (Latent factors lie between observed factors and real outcomes) We therefore included latent factors in our Real World Outcomes modes within SatisfactionSolve™.

In the real world, not the world of rarefied theory, most consumers must reach thresholds before they do anything. That is, whatever behavior you want to elicit (initial purchase, more use of your services, cross-sell, etc.) we must provide consumers with enough "stuff" (benefit) to "get them off the dime." That is why we measure many kinds of Behavioral Change Thresholds (BCT's) in the survey. Quite importantly we measure these thresholds at the level of the individual respondent. This allows our E-customers (the calibrated copy of the consumer) to respond as actual consumers do.

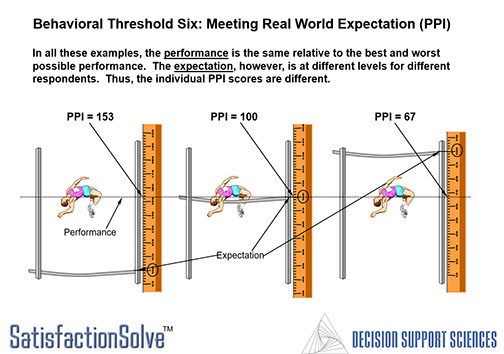

One of the classic mistakes made by traditional CSM is that it asked consumers what they expected...and then naively assumed that we must deliver on that expectation. In fact, if we place NO real-world constraints on any key driver (e.g. hold time on phone) the consumer will almost always ask for the "the sun, the moon and the stars." That is, stated expectation far overstates what consumers really expect. The best way to measure real expectation is to find the minimum performance level that does not create disutility (dispreference.) In contrast, our approach uses apportioned expectation (AE) AE allows us to focus our efforts in ways that maximize marginal benefit....by improving the key drivers that cause disutility (negative consumer outcomes.)

And what about ROI? In terms of ROI, historically, over 95% of CSM engagements have actually lost money. Let's expose another CSM myth. CSM tells us to "exceed expecatations." This makes for a "feel good" motto - but is simply foolhardy to give consumers exactly what they want. Doing so will bankrupt you...and barely dent Real World Outcomes (RWO's). in contrast, we attach ABC costing amounts to every change level of every key driver. Thus, we know exactly how much a change will cost to implement and to maintain. This allows our outcome models (e.g. sales, switching, etc.) to maximize those outcomes at the lowest cost to implement and the lowest cost to serve.

One of the most familiar misnomers in marketing is the concept of a "key driver." The problem with this concept? Most drivers are not "key." In fact, recent research has shown that only about one fifth of the drivers measured in CSM are truly "key"...and those key drivers differ from individual to individual. This is also why traditional CSM modeling also tends to fail. Traditional CSM modeling is aggregate modeling - it groups consumers together to determine the best predictors. The problem? Aggregate models wash out individual preferences. In contrast, CVM 1) determines key drivers at the individual respondent level and 2) validates those key drivers by calibrating them to real-world choice behavior.

Once we have a) obtained the key drivers, and b) solved for the real-world thresholds that link to real world outcomes, and c) adding in the cost to implement and the cost to serve... then what? With this next generation of data we are finally ready to explore what happens when we close the gap between our current performance on the key drivers and real-world expectation. In our typical CVM protocol we do "gap closure" two ways, with cost data enabled and cost data disabled. The decisioning module that performs automatic, cost-informed gap closure is the CSI (Customer Satisfaction Index) simulator built into SatisfactionSolve™.

SatisfactionSolve™ is not only for customer satisfaction! In fact SatisfactionSolve™ has embedded within it ALL the capabilities of ProductSolve™. Why you might ask? ProductSolve™ is the premier decision support platform to identify which changes to you products and services will maximize Real World Outcomes (RWO's) at the lowest cost to implement and the lowest cost to maintain.

One of the most powerful discoveries of CVM was that continuous tracking and measurement could be performed far less expensively and less frequently than demanded by CSM. Accordingly we have a two tier, staged approach to continuous tracking and measurement that measures only those market features with low latency - those features that are both important and change relatively quickly. Our tracking approach, then, not only saves money, but ensures that neither noisy market metrics nor the consumer are "over-measured." Lastly CVM has a report generation tool that spits out customized reports at the touch of a button.

Recognizes that Conventional CSM has Failed

Replaces CSM with Far Deeper CVM Measures

Links to RealWorld Outcomes (RWO's) Like Sales, New Customer Acquisition, etc.

Finds Behavioral Change Thresholds (BCT's)

Measures Real World Expectations (RWE's)

Quantifies Costs to Implement/Maintain (CIM)

Identifies True Key Drivers (TKD): Those That Best Improve Real World Outcomes (RWO)

Closes TKD Gaps Between Performance and Real World Expectation (RWE)

Includes All the RWO Simulation and Risk Mitigation Tools from ProductSolve.

Performs Full Tracking and Continuous Improvement of All the Above

<

>

EXAMPLE CLIENTS

Retail and Commercial Banking

We have deployed repeated customer satisfaction studies for five of the top 20 U.S. and Canadian banks.

Other Financial Firms

We have deployed numerous national customer satisfaction studies for leading mutual fund, investment firm, and trust companies.

Retail and Commercial Banking

Other Financial Services Firms